Does your income fall into the category of taxable net income? If yes, then do you file your taxes? Do you have an NTN number? If your answer to any of these TWO questions is in the negative, stop everything else and read this!

So the question is, what is an NTN number? National Tax Number (NTN) is a necessity for every individual, whether salaried or self-employed. The NTN is required for filing taxes, hence you need to make sure that you have this number with you. For salaried persons, the NTN can be generated by your employers however, it is not mandatory for them to facilitate their employees.

Being a responsible citizen, it is your responsibility to get this number from the Federal Board of Revenue (FBR) and file your taxes on time, accurately. Here, we walk you through the process of obtaining your personal FBR NTN number.

The whole process is extremely easy and convenient. All you have to do is to visit the FBR website and complete the below-mentioned steps.

National Tax Number and Its Need

The National Tax Number is extremely important for filing your income tax. Being a non-filer, you will have to pay a higher and an increased percentage of withholding tax on banking transactions, property transactions, vehicle purchase, and tax.

If your salary falls within the bracket of taxable net income, you must obtain an NTN to become a filer and also, file a tax return. You can do so by following these steps:

How to Obtain National Tax Number (NTN) through IRIS [Step by Step Guide]

FBR has launched an e-portal through which it offers NTN number registration online. So, if you’re looking for answers to questions like how to get NTN number and how to apply for NTN number, this user-friendly IRIS FBR system is the answer.

Follow these steps to obtain your personal National Tax Number.

- Visit the Federal Board of Revenue’s official website: https://iris.fbr.gov.pk/public/txplogin.xhtml

The above screen will appear when you click on the link. Select ‘Registration for Unregistered Person’ in order to proceed.

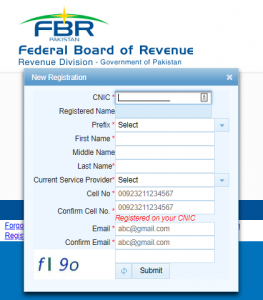

- A short form will appear on the screen now (see below). This form requires you to provide your CNIC number, name, phone number, and email. Make sure that you enter all details accurately, and double-check your mobile number and email address.

- After you click ‘submit’ with all your details, you will receive two codes. One on your mobile phone, and the other one on your email address.

- Enter the two codes on the next screen. Make sure that you enter the mobile code and the email code in their respective boxes.

- After you validate your account with the codes, your password and PIN will be sent to you on your mobile phone. Your User ID will be your CNIC.

- You can then log in to IRIS FBR using your username and your password.

- After logging in, click on ‘draft’ on the left side of the screen.

- Here, you will find a submodule named ‘registration’.

- Click on it, and a registration form will appear.

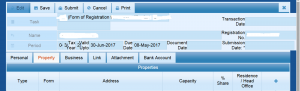

- Click on the ‘edit’ button in the menu bar and start editing the form.

- The form will require you to enter details in the ‘property’ tab and ‘link’ tab. Provide your employer’s NTN number under the ‘link’ tab. The ‘business’ and ‘bank’ tab are to be left blank.

- Submit the registration form.

If in case, the form asks to provide a percentage share anywhere, you may fill it by writing ‘100%’. Double-check all the information that you provide or else you may land in hot water for providing false information to the FBR.